Technical analysis cares about one thing and one thing only, price action. The takeaway being that the stock market is only boiled down what is reflected in the price. This is because the market hates uncertainty. The stock market is forward looking in the sense that it prices in future events before they happen. Often times in fundamental analysis I'll see individuals let their own judgment of some macroeconomic event cloud their investment analysis. One of the beauties of technical analysis is the removal of human emotion in decisions. #investments #trading #riskmitigation #riskmanagement #activemanagement #activeinvesting #portfoliomanagement #retirementplanning #retirement #income

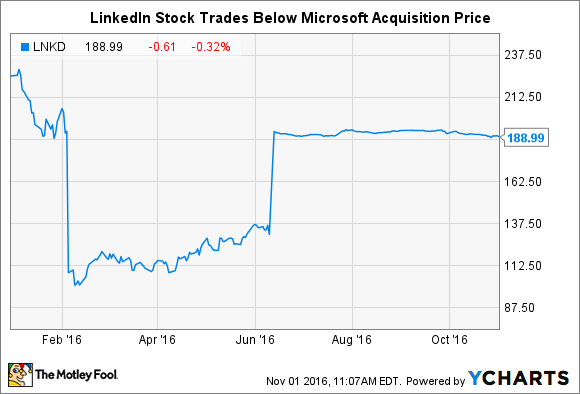

#Linkedin stock chart free

What is the real cost of volatility in your portfolio right now? Reach out and let me give you a free second opinion. It's important to remember, you don't need to make as much money if you don't lose as much. The reality is that protecting principal should always be the number one priority before looking at returns. "What kind of returns? What's the most we can make? What's the upside?"Īt Portfolio Medics we teach different questions such as what is the downside risk of the way you're invested currently? What is your trading mechanism for making buy and sell decisions? How correlated are your investments to the market? These questions are important because they will help you to understand how much volatility your portfolio will assume and what your plan is if the market begins to fold. One of the biggest traps I see many investors fall into is the trap of returns. #investment #data #investing #activemanagement #riskmanagement #retirement #portfoliomedics

But what if you don't have any idea what the chart looks like for the next week, month, or quarter in the future? Will you be able to successfully find the proper buy and sell opportunities while managing your overall risk?" The answer is an obvious "no" for them, but that doesn't mean there isn't a way with data to make those decisions going forward based on probabilities.ĭo not hesitate to reach out to me for a second opinion on what you are currently doing in your retirement/investment accounts! I look at them and say, "You just successfully mitigated risk and found the opportunities of entry and exit on that existing chart. Everyone is capable of doing so as they circle the lows as buying opportunities and then they circle the high points and say "I'd sell here".

Often times I'll show individuals a chart of a stock or index with ups and downs, and I'll ask them to circle the points at which they would have bought and sold the stock in hindsight applying a buy low/sell high approach.

0 kommentar(er)

0 kommentar(er)